TL;DR

- Inflation steals your wealth

- It reduces the purchasing power of your money

- Government money is inflationary

- Bitcoin is deflationary

- A few simple rules of thumb can help you protect your wealth and grow it

Let’s begin

You know how it goes. You get a raise at work and feel like a million bucks.

Well, only until you realize your cost of living has gone up and your raise doesn’t go as far as it used to.

You might not be a victim of theft, but inflation sure feels like it.

What is inflation?

Inflation is “a general increase in prices and decrease in the purchasing power of money.”

In other words, when inflation goes up, your money doesn’t go as far as it used to.

How does inflation happen?

Inflation is caused by an increase in the money supply.

That’s just a fancy way of saying that the government is printing money.

To be precise, it is the central bank of a country that prints money and it prints it digitally these days.

Below is a video of the Chair of the Federal Reserve of the United States, where he acknowledges the Federal Reserve printed trillions of dollars during Covid.

But the coronavirus pandemic wasn’t an anomaly. The US dollar has been losing its value for a very long time.

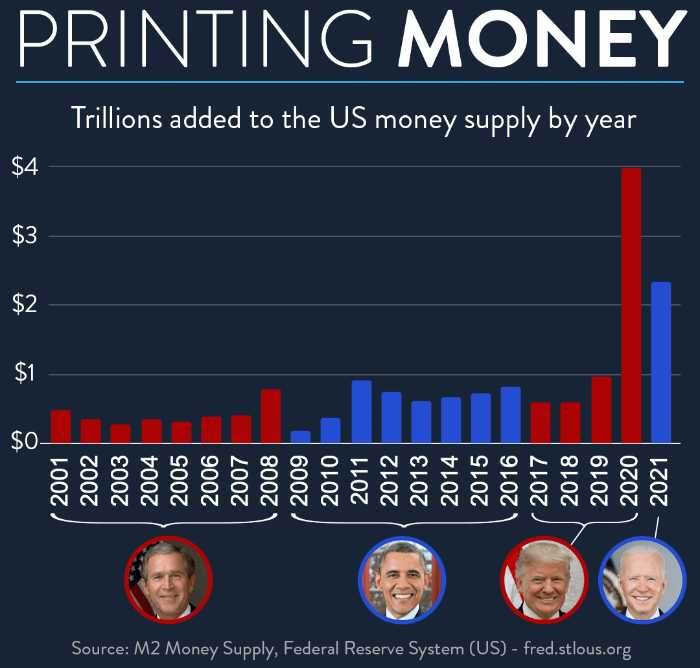

Below you will find an illustration that shows how much money was printed in the last 20 years – only in the United States!

In 2008 the US government injected $700 billion into the economy in an attempt to stimulate it during the Great Recession.

But money printing isn’t a phenomenon that started 20 years ago.

Governments and central banks have used this practice ever since the U.S. dollar lost its peg to physical gold, back in 1971.

In 1960, you could buy a new car for $2,752. In 2020 dollars, that same car would cost you $23,017.

That means the purchasing power of the dollar has decreased by 92% since 1960.

When there’s more money chasing the same number of products and services, prices go up.

This is why inflation is a “silent thief.” It slowly and stealthily erodes your wealth over time.

How inflation affects you

Inflation affects everyone differently.

If you’re on a fixed income (i.e., pension) your income doesn’t go up with inflation, so you can’t keep up with rising costs.

If you have variable income, like investments or self-employment, your ability to keep up with rising costs depends on how well your investments and business do.

When inflation hits, most people cut their spending, which tends to hurt business owners.

While the government tries to control inflation by raising interest rates, sometimes they don’t act quickly enough or they raise rates too high, causing a recession).

The latest interest rate hikes by the Federal Reserve caused many companies to lay off employees, hurting people from all walks of life.

How can you protect yourself from inflation?

One way to avoid inflation is to invest in assets that have a set, predictable issuance schedule like Bitcoin.

Bitcoin has been a good hedge, because it has a set supply no one can increase, no matter what.

The current annual inflation rate of Bitcoin is 1.82%, and it will decrease by 50% every 4 years. In 2024, Bitcoin’s inflation rate will go down to 0.91%, and in 2028 it will go down further to 0.46%.

The US government, on the other hand, can print as many U.S. dollars as it wants, which means that the inflation rate is less predictable.

In 2022, we’ve all seen inflation going through the roof, with a double-digit percentage increase, deeming people struggling to make ends meet.

With Bitcoin, you have better chances that your investment will hold its value, or even increase in value in the long run and ultimately protect your purchasing power.

What next?

Regardless of the economic environment, there are a few rules of thumb you should follow religiously:

- Don’t spend more than what you make

- Pay off high-interest debt (i.e., credit card debt) before you buy things you don’t need

- Save money so you have a cushion to fall back on

- Invest in assets that can’t be printed out of thin air

- Live below your means so you have room to cut spending when inflation hits

- Always invest in your financial literacy, by getting an education or learning new skills

No one can completely protect themselves from inflation, but by taking these steps you can control how it affects you.